By Hal Harvey, CEO, Energy Innovation

Momentum is growing for a carbon tax to help solve climate change—and for good reason: Properly designed, it induces energy-efficient equipment; balances renewable energy with fossil incumbents; and shows consumers the societal cost of pollution, security threats, and climate change from fossil fuels.

Unlike many other policies, a carbon tax affects investments and behavior, while pricing socially undesirable behavior (pollution) for the most efficient source of revenue. If proceeds are even modestly spent on R&D and strategies accelerating clean energy, it engenders a virtuous cycle, speeding decarbonization.

For these reasons, a carbon tax attracts adherents across the political spectrum—from four-time Republican Cabinet member George Shultz and Bush Treasury Secretary Hank Paulson, to Senator Bernie Sanders. From the conservative American Enterprise Institute to the progressive Center for American Progress and a half-dozen oil majors (none American).

A carbon tax would be very useful, but isn’t the only climate change solution—and indeed, it actually works quite poorly in certain parts of the economy, for three reasons: Some sectors are essentially indifferent to pricing; some consumers (including most industries) are likewise largely indifferent; and the politically realistic ceilings of a carbon tax are below meaningful effects in many economy sectors.

Indifferent or impervious sectors

Buildings, which use about 40 percent[1] of America’s energy, illustrate impervious sectors. Those responsible for a building’s design rarely pay for its energy—a subdivision developer or office architect isn’t paying your monthly utility bill. Structural choices about your building’s efficiency instead belong to someone safe from the pain of energy waste.

Now flip it: Renters and many owners aren’t positioned to ensure walls are insulated, ducts wrapped, or windows glazed. A carbon tax simply adds to the energy bill—it does not align who makes efficiency decisions with who pays for them.

This market failure is called a “split incentive,” since those making capital decisions do not pay utility bills. Extrapolate this phenomenon out from one apartment or office to the 100 million buildings in America and the problem’s scope becomes clear.

A carbon tax addresses one market failure—using public resources like the atmosphere as a free dumping ground for pollution—but misses other market failures altogether. In the building sector, the tax creates a penalty without a remedy.

Other sectors are largely insulated from carbon tax effects: Most utilities in America are monopolies under a public utilities commission’s (PUC) jurisdiction, earning profits as the PUC allows. Because PUCs generally allow the full recovery of fuel costs—including taxes—with the logic that utilities cannot control fuel prices, any extra cost of a carbon tax will likely be passed onto consumers, without generating many incentives. Some utilities operate under market systems where power plant dispatch is governed by cost,[2] but the effect of a carbon tax remains attenuated in much of the country.

Indifferent consumers

Next consider consumer indifference and the high barrier to price response: One study sold identical refrigerators, some labeled with low energy consumption and higher purchase price, the others with lower price but higher energy consumption. By altering these numbers, the study’s authors determined consumers’ implied discount rate: Consumers would only make incremental capital investments if earning back money in two years or less, implicitly demanding a 50 percent or greater annual return.

In contrast, the utilities supplying electricity to refrigerators routinely invest in technologies requiring eight or more years’ payback. The payback requirement difference between utilities’ for supply (12 percent or so) and consumers’ for efficiency (50 percent) unnecessarily costs billions of dollars and billions of tons of carbon pollution every year—and a carbon tax doesn’t fix it. Consumers systematically undervalue the fuel savings of more efficient vehicles.

Even big, profit-maximizing industries are susceptible to leaving the proverbial $20 bill on the sidewalk.[3] Consider the natural gas industry’s strong incentive to avoid leaks: More leaks mean less product to sell, but significant evidence reveals missed opportunities to reduce pollution while generating profits.

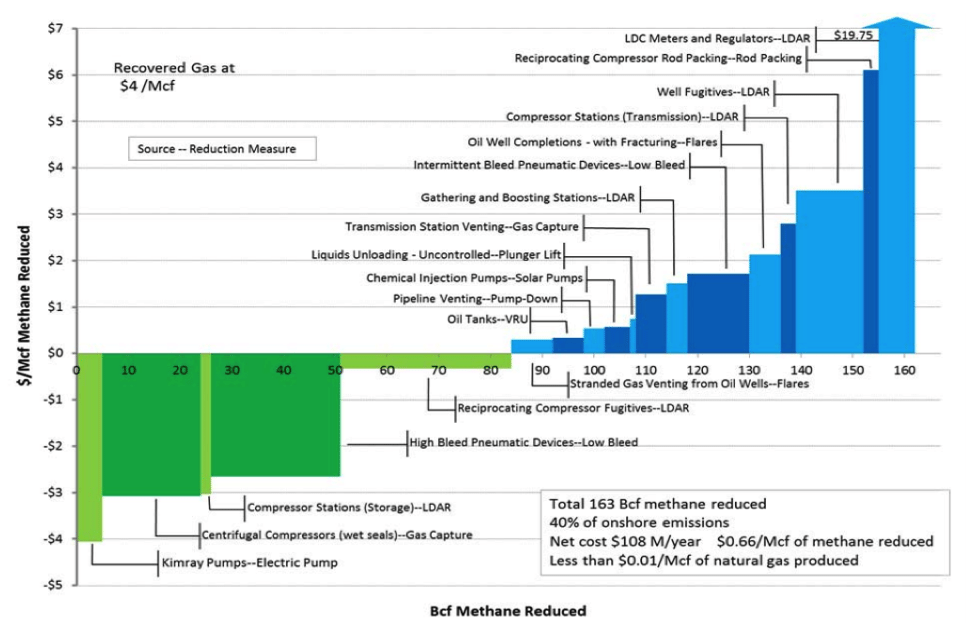

Figure 1. Significant net negative costs for natural gas leak abatement shows, in green, negative costs (e.g. profit-generating) options for natural gas (ICF International study)

Why is the natural gas industry wasting opportunities to save money on energy? Even though the economics of reducing waste exist, their comparatively small size does not merit CEO attention, or even the dispatch of a maintenance team. Again, while a carbon tax can provide a helpful nudge, it fails to fully repair this.

This indifference threshold is even higher for companies outside the energy space. Major corporate CEOs must focus on their company’s product innovation, sales, capital markets, regulatory compliance, and public relations—not facility energy savings. Energy is low on the list of concerns: Even where efficiency economics are strong, management attention simply isn’t. Most companies also have separate budgets and decision-making processes for capital and operating expenses, so savings in one at the cost of expenditures in another rarely find favor. While a carbon tax would help in customer and industry realms, it does not ultimately overcome these barriers.

Industries already overlooking energy savings opportunities will continue to do so even with a carbon tax. The famous McKinsey cost curves show vast carbon savings, paying for themselves in reduced economy-wide energy savings, sitting untapped.

Acceptable levels of carbon tax don’t affect some sectors

Finally, socially acceptable carbon tax levels simply don’t make much of a difference in some parts of the economy. For example, translate a carbon tax into a gasoline tax: A $50 per ton carbon tax, higher than most proposals, translates into about 50 cents per gallon of gasoline. Dropping that real number into the market would cost any politician their job, but we constantly see variations of this magnitude within a year, and the jumps have not yet saved the world.

Would that gas tax actually reduce CO2 emissions or gasoline consumption? Would imposing this “external” cost on consumers extricate us from patrolling Mideast shipping lanes and oil terminals?

The answer doesn’t inspire much hope. Consumers hate gas price hikes (and gas taxes), but don’t much change behavior because of them. The political costs of a gas tax are high, but environmental and national security benefits are low—it’s a Venn diagram whose circles are miles apart.

Picking the right policy

A carbon tax works for energy-intensive industries not easily relocated to cheap energy areas, with technology options to reduce energy waste. It is great for market-based electricity dispatch decisions, and where competing options are closely priced on the margin (although renewable energy already has zero marginal cost, so it gets dispatched regardless, and a carbon tax has no effect).

There is no question a carbon tax would help in some sectors, provide a good signal for infrastructure decisions, and efficiently generate revenue. It aligns choices with capital purchases with incentives for daily use. But for CO2 abatement, the most important policies worldwide are well-designed performance standards.

Performance standards are simple and, when properly designed, they work. We expect minimum health and safety standards in many realms: untainted meat, buildings not prone to burning down, and cars that survive most crashes. Those social benefits are profound and come from smart performance standards. We do not impose a tax on unsafe cars, or on flammable hotel rooms, or meat with ptomaine. We simply expect them to be consumer-ready.

The same goes for energy in many instances: Good building energy codes reach 100 percent of new buildings, and the best have reduced energy use 75 percent or more. No tax remotely approaches this effect. These codes are no more complex or controversial than requirements for a sound foundation or a sprinkler system. Just do the right thing, at the start, across the board.

By requiring products to perform well before entering the marketplace, consumers do not face transaction costs for optimal performance. Unsurprisingly, performance standards have delivered hundreds of times as much carbon savings as all the taxes in the world combined.

The upshot: Carbon taxes are very helpful, but mainly as a complement to performance standards. Setting a price on pollution is a good idea with important consequences. But it is not a sole solution, or even a primary one. It must be paired with serious performance standards, and serious R&D.

[1] http://buildingsdatabook.eren.doe.gov/ChapterIntro1.aspx

[2] Note that a carbon tax would nudge a shift from coal to gas in existing power plants; it would not affect the dispatch of renewables, since the marginal cost of these is already close to zero. A long-term, credible carbon tax, with price signals affecting utilities’ bottom lines, would affect their power plant construction decisions.

[3] This is how economists like to describe these opportunities, as $20 bills lying around to be claimed. They do this to emphasize the idea that people or firms already chase down every cost-effective efficiency option.

_____________

Hal Harvey is the CEO of Energy Innovation. He is also a Senior Fellow for Energy and the Environment at the Paulson Institute. Previously, he was the founder and CEO of ClimateWorks Foundation, a network of foundations that promote polices to reduce the threat of climate change. From 2001-2008, he served as Environment Program Director at the William and Flora Hewlett Foundation. From 1990 through 2001, Hal served as founder and President of the Energy Foundation. Hal has served on energy panels appointed by Presidents Bush (41) and Clinton and has published two books and dozens of articles on energy and national security issues. He is President of the Board of Directors of the New-Land Foundation, and Chairman of the Board of MB Financial Corporation. Hal has B.S. and M.S. degrees from Stanford University in Engineering, specializing in Energy Planning.